Specific analysis of the technical, territorial, economic, financial and administrative-management of real estate operations are essential to guarantee future profitability. It is necessary to build valuation models that allow for the identification and the quantification of critical parameters, the processing of the information and the interpretation of the results. Decision making processes in the context of real estate operations are addressed through the development of a feasibility study, that aims at answering the question “will it work?” for a specific project proposal. In principle, the method is based on the identification of the full range of costs and incomes of the project in order to allow the investor to understand if minimum objectives will be achievable. A very important part of the overall feasibility study is related to the financial analysis which normally can be addressed through the Discounted Cash-Flow Analysis. Particularly, this technique used to derive economic and financial performance criteria for investment projects in the form of synthetic and easy to interpret indicators that allows the Decision Maker to understand if the project should be accepted or rejected.

- Evaluation of the administrative feasibility of a project with respect to the planning constrains in order to ensure all aspects of the approval of the project (i.e., destinations referred by planning instruments, buildable volumes and areas, infrastructure expenses, urbanizations, etc.).

- Development of market analysis for supporting real estate investment decisions, including study of the local submarket, analysis of the specific characteristics of the property, demand and supply analysis, study on the competitors, prediction of future revenues.

- Estimate of construction costs that allows to establish a preliminary evaluation on the implementing cost of the program. The estimation concerns the cost for acquisition of the area, urbanization, construction of the buildings, contribution to building permit, charges related to planning and development process, operation and management expenses.

- Estimate of production times for a correct prediction and realistic timeframes of the program. In this context, the Program or Project Evaluation and Review Technique (PERT) is applied.

- Estimate of revenues, with reference to magnitude and timing, in order to forecast the expected incomes produced by the real estate operation.

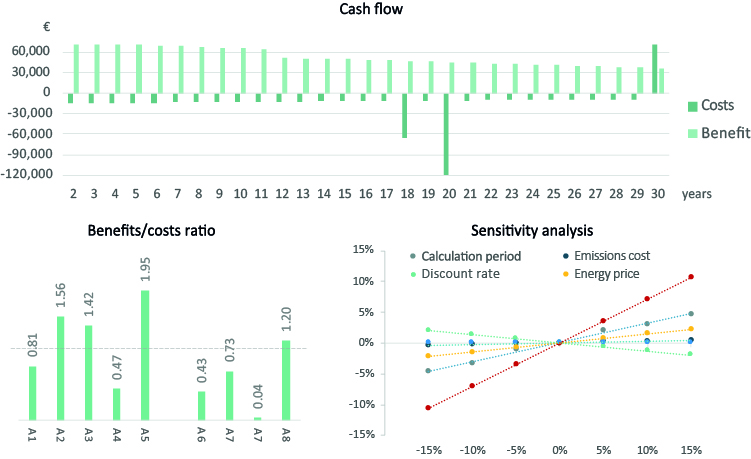

- Analysis of the profitability of the real estate operation by means of the development of the Discounted Cash Flow Analysisand definition of financial performance indicators (Net Present Value – NPV and Internal Rate of Return – IRR)

- Risk analysis that allows for incorporating the risk factor in the assessment of the convenience of the real estate operation. The uncertainty can be included in the valuation models by means of sensitivity analysis or making use of more sophisticated models such as Decision Trees and Monte Carlo simulation.

BECCHIO, C., BERTONCINI, M., BOGGIO, A., BOTTERO, M., CORGNATI, S.P., DELL’ANNA, F. (2019). The Impact of Users’ Lifestyle in Zero-Energy and Emission Buildings: An Application of Cost-Benefit Analysis. Calabrò F., Della Spina L., Bevilacqua C. (eds) New Metropolitan Perspectives. ISHT 2018. Smart Innovation, Systems and Technologies, vol 100, pp.123-131. Springer, Cham.

BECCHIO, C., BOTTERO, M. C., CASASSO, A., CORGNATI, S. P., DELL’ANNA, F., PIGA, B., SETHI, R. (2017). Energy, economic and environmental modelling for supporting strategic local planning. Procedia Engineering, 205, 35–42.

BECCHIO, C., BOTTERO, M., M., CORGNATI, S., DELL’ANNA, F., DELMASTRO, C., PESCE, E., VERGERIO, G. (2019). A Cost-Benefit Analysis based model to evaluate the retrofit of a reference district. Proceedings of Building Simulation 2019: 16th Conference of IBPSA.

BECCHIO, C., BOTTERO, M.C., CORGNATI, S.P., DELL’ANNA, F. (2018). Decision making for sustainable urban energy planning: an integrated evaluation framework of alternative solutions for a NZED (Net Zero-Energy District) in Turin. Land Use Policy, 78, 803–817

BOTTERO, M., D’ALPAOS, C., DELL’ANNA, F. (2018). Boosting Investments in Buildings Energy Retrofit: The Role of Incentives. Calabrò F., Della Spina L., Bevilacqua C. (eds) New Metropolitan Perspectives. ISHT 2018. Smart Innovation, Systems and Technologies, vol 101, pp. 593–600. Springer, Cham

DELL’ANNA, F., VERGERIO, G., MONDINI, G., CORGNATI, S. (2019). A new price list for retrofit intervention evaluation on some archetypical buildings. Valori e Valutazioni, 22, 3-17.

Co-Benefit in energy field

The concept of co-benefit is commonly adopted to define any positive impact of a policy, program or project, which stands alongside the primary objective. Indirect benefits concern human health and well-being, as well as environmental, economic and social aspects. The concept, investigated since the 1990s, is now recognized worldwide by numerous organizations and the European Commission, to provide a better understanding of the economic value of the measures envisaged or applied (IPCC 2015).

The term co-benefit aims to capture a reality that is often overlooked, highlighting how investments in energy efficiency can provide many and different advantages to different subjects involved in the project. The most recent focus has been on the incorporation of co-benefits (co-impact) into decision-making frameworks to take into consideration the full range of stakeholders involved in energy investments (Ürge-Vorsatz et al. 2014). In this field of application, the commonly used approaches refer to the Life Cycle Assessment (LCA), the Life Cycle Cost (LCC), the Cost-Benefit Analysis (CBA) and the Multi-Criteria Decision Analysis (MCDA) (Strantzali and Aravossis 2016). These evaluation methods allow to evaluate a project from different points of view considering the different externalities generated. In the international literature, the criteria considered to examine energy investments are mainly divided into four families that evaluate the technical, economic, environmental and social factors of the project (Wang et al. 2009). But it is difficult to describe a project from all points of view, given that current literature is unable to provide a comprehensive response to the quantification of these impacts (Becchio et al. 2018; Bisello and Vettorato 2018; Dell’Anna et al. 2020). Theoretically, each of the co-benefits can be estimated. To do this, the impact of the policy or initiative is first quantified in physical units (e.g. tons of pollutants avoided, years of life saved, number of additional full-time jobs created, etc.) before transformation in a monetary value. A critical point of this analysis is that not all co-benefits can be assessed directly in monetary terms as if they were consumer goods. Therefore, it is necessary to apply non-market techniques to estimate them. These techniques investigate consumer preferences from individual purchasing habits (revealed preferences) or by asking them directly for their preferences (stated preferences).

Our studies clearly trace the path followed in this area of research. A line of research is represented by publications concerning the economic-financial evaluation of energy investments. This category includes publications based on the application of stated and revealed preferences methods, to study consumer behaviour towards energy investments (Becchio et al. 2019; Bottero et al. 2020; Bottero et al. 2019). Another line concerns the application of techniques to support the decision to guide the energy transition processes at the district level (Becchio et al. 2018; Becchio et al. 2017).

Most of the research has been developed in collaboration with the Energy Center Lab of the Politecnico di Torino (Becchio et al. 2020, Borchiellini et al. 2017). With reference to the most significant publications “Decision making for sustainable urban energy planning: an integrated evaluation framework of alternative solutions for a NZED (Net Zero-Energy District) in Turin” proposes an evaluation method developed by the Cost-Benefit Analysis in order to include socio-economic benefits -environmental generated by the project (Becchio et al. 2018). An energy and economic approach is applied to a real case concerning the energy requalification of a district in Turin. “Of comfort and cost: Examining indoor comfort conditions and guests’ valuations in Italian hotel rooms” estimates the willingness of consumers to pay for excellent comfort conditions in hotel rooms using the contingent evaluation method (Buso et al. 2017).

BECCHIO, C., BERTONCINI, M., BOGGIO, A., BOTTERO, M., CORGNATI, S.P., DELL’ANNA, F. (2019). The Impact of Users’ Lifestyle in Zero-Energy and Emission Buildings: An Application of Cost-Benefit Analysis. Calabrò F., Della Spina L., Bevilacqua C. (eds) New Metropolitan Perspectives. ISHT 2018. Smart Innovation, Systems and Technologies, vol 100, pp.123-131. Springer, Cham.

BECCHIO, C., BOTTERO, M., BRAVI, M., CORGNATI, S., DELL’ANNA, F., MONDINI, G., VERGERIO, G. (2020). Integrated Assessments and Energy Retrofit: The Contribution of the Energy Center Lab of the Politecnico di Torino, Mondini G., Oppio A., Stanghellini S., Bottero M.C., and Abastante F. (eds.) Values and Functions for Future Cities, pp. 365–384.

BECCHIO, C., BOTTERO, M., CORGNATI, S.P., DELL’ANNA, F. (2017). A MCDA-Based Approach for Evaluating Alternative Requalification Strategies for a Net-Zero Energy District (NZED). Zopounidis C. and Doumpos M. (eds.) Multiple Criteria Decision Making. pp. 189–211. Springer, Cham

BECCHIO, C., BOTTERO, M.C., CORGNATI, S.P., DELL’ANNA, F. (2018). Decision making for sustainable urban energy planning: an integrated evaluation framework of alternative solutions for a NZED (Net Zero-Energy District) in Turin. Land Use Policy, 78, 803–817

BORCHIELLINI, R., CORGNATI, S., BECCHIO, C., DELMASTRO, C., BOTTERO, M., DELL’ANNA, F., ACQUAVIVA, A., BOTTACCIOLI, L., PATTI, E., BOMPARD, E., PONS, E., ESTEBSARI, A., VERDA, V., SANTARELLI, M., LEONE, P., LANZINI, A. (2017). The Energy Center Initiative at Politecnico di Torino: Practical experiences on energy efficiency measures in the municipality of Torino. International Journal of Heat and Technology, 35, 196–204.

BOTTERO, M., BRAVI, M., CAVANA, G., DELL’ANNA, F., BECCHIO, C., CORGNATI, S.P. (2019). Energy retrofit and investment decisions: individuals’ preferences valuation through a Choice Experiment. Geoingegneria Mineraria e Ambientale, 158, 11-24

BOTTERO, M., BRAVI, M., DELL’ANNA, F., MARMOLEJO-DUARTE, C. (2020). Energy Efficiency Choices and Residential Sector: Observable Behaviors and Valuation Models. Mondini G., Oppio A., Stanghellini S., Bottero M.C., and Abastante F. (eds.) Values and Functions for Future Cities. pp. 167–179. Springer, Cham

BOTTERO, M., BRAVI, M., DELL’ANNA, F., MONDINI, G. (2018). Valuing building energy efficiency through Hedonic Prices Method: are spatial effects relevant?. Valori e Valutazioni, 21, 27-40

BUSO, T., DELL’ANNA, F., BECCHIO, C., BOTTERO, M.C., CORGNATI, S.P. (2017). Of comfort and cost: Examining indoor comfort conditions and guests’ valuations in Italian hotel rooms. Energy Research & Social Science, 32, 94–111 (2017).

DELL’ANNA, F., BOTTERO, M.C., BECCHIO, C., CORGNATI, S.P., MONDINI, G. (2020). Designing a decision support system to evaluate the environmental and extra-economic performances of a Nearly Zero-Energy Building. Smart and Sustainable Built Environment.

DELL’ANNA, F., BRAVI, M., MARMOLEJO-DUARTE, C., BOTTERO, M.C., CHEN, A., (2019). EPC green premium in two different European climate zones: A comparative study between Barcelona and Turin. Sustainability, 11, 5605.